When Should You file Bankruptcy

Ferguson & Ferguson

Attorneys at Law

January 20th, 2016

When is the right time to file for bankruptcy? It is probably the most ask question during our bankruptcy consultations. If you, a debtor, files too early, it could cause problems later on. If you wait too long, and run through your saving and retirement, you may be unable to qualify for a Chapter 7 and be forced into a Chapter 13.

The decision when to file bankruptcy often is determined by your employment status. If unemployed or in a temporary job, it might be in your best interest to delay filing. Further, we often must review any purchases within the last 90 days. Any small or large purchases made within the last 90 days could appear to be fraudulent. A creditor can claim purchases are fraudulent even after 90 days. Waiting more than 90 days will remove the presumption of fraud.

Many people wait too long to file, stressing for months or even years trying to pay off debt. Often times they spend all of their savings and/or retirement funds. Many people suffer for years trying to pay off debt, only to arrive in our office no better off than they were years earlier. Waiting too long can cause you to lose the option of Chapter 7, and be forced into filing under Chapter 13. If that happens, you will be forced to pay unsecured creditors for up to five years.

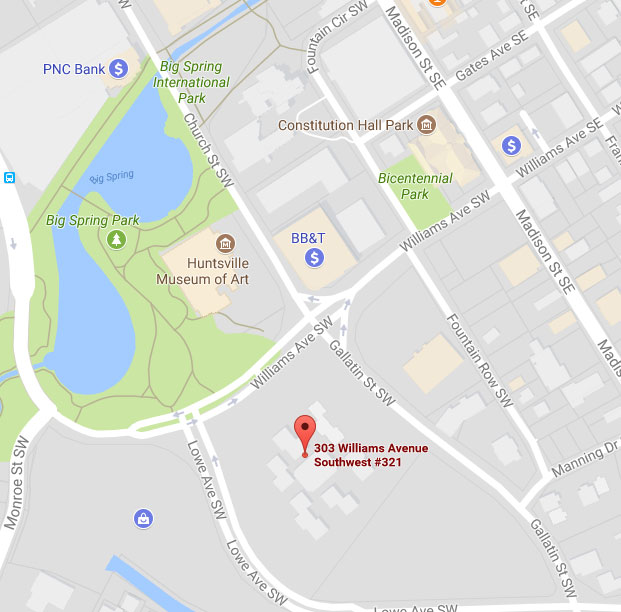

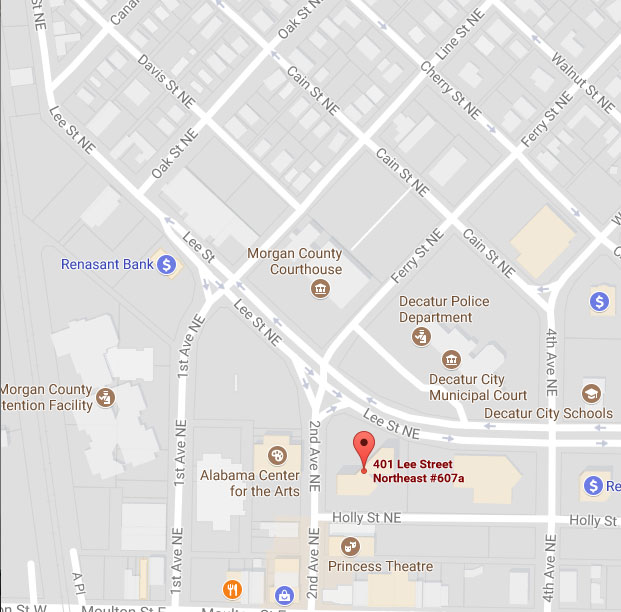

If you are having financial difficulties, don’t wait until the last minute to find out your legal rights. At the law firm of Ferguson & Ferguson, we offer free bankruptcy consultations. We understand the stress you are under, and we are here to help. Call now for your free consultation. Call 256-534-3435 in Huntsville, or 256-350-7200 in Decatur.