BANKRUPTCY LAWYERS IN SCOTTSBORO AL

For over 25 years, the attorneys at the Law Offices of Ferguson & Ferguson have been fighting for the consumers of Alabama. We offer free, no obligation bankruptcy consultations. Our bankruptcy fees are among the lowest in the North Alabama area. We can often quote you a fee immediately when you call after just a few simple questions. We offer flexible payment plans for all matters, and can often file a Chapter 7 bankruptcy the next day. If you are from Scottsboro, make sure to call us if you have any questions or want a free phone consultation. Give us a call and see just how affordable our bankruptcy fees can be. CALL NOW. Call 256-534-3435. We are here to help you.

Do you find that you are you losing sleep worrying about your bills and how you are going to pay them? Are creditors making harassing phone calls and sending threatening letters? Are you worried you might lose your vehicles or home to foreclosure? Are you worried about your wages being garnished? When you came across our Scottsboro, Alabama bankruptcy website today, it was not by chance. Like hundreds of Scottsboro, Alabama residents, and millions of others, you are likely looking for answers and solutions to your financial problems. Imagine your life without debt and the harassing calls of creditors. We understand that filing for personal bankruptcy can be a difficult decision to make. Financial problems place a great deal of stress on families and households in Alabama. Often the only solution a person can find is to file for personal bankruptcy. People often think that filing bankruptcy in Alabama means losing everything they own. Nothing could be further from the truth.

Helping Scottsboro AL Debtors Eliminate Debt Through Bankruptcy

There were hundreds of bankruptcy filings in Scottsboro, Alabama last year. There are over 1 million bankruptcy filings nationally each year. The average US household has over $16,000.00 in debt. In 2011, 62% of all personal bankruptcies had a medical cause. One of the main purposes of Bankruptcy Law is to give a person, who is hopelessly burdened with debt, a fresh start by wiping out his or her debts. So if you’re having financial concerns and considering bankruptcy we can help you decide if bankruptcy is the right solution for you. Our Scottsboro bankruptcy lawyers keep abreast of ever-changing federal bankruptcy laws and provide our clients with the best, most current advice. The right choice in legal help can make a difference as you begin to build a better tomorrow. Call Ferguson & Ferguson. Our Scottsboro, Alabama attorneys are here to help you with your debt.

How Can We Help?

Many people seek our help because of harassing calls from relentless creditors, or because they are facing a wage garnishment or foreclosure. The stress that results from financial difficulties can be overwhelming, but it does not have to be that way. We have helped hundreds of Scottsboro, Alabama and thousands of Alabama clients break free from tens of millions of dollars of debt. Bankruptcy can sometimes be overwhelming, but our Scottsboro, Alabama attorneys will be with you all the way. Our consultations in bankruptcy cases are conducted with our attorneys in person. Our Scottsboro bankruptcy lawyers will help you understand your Chapter 7 and Chapter 13 options. We will explain the bankruptcy laws to ensure a smooth bankruptcy process. At the offices of Ferguson & Ferguson we understand your anxiety about your financial situation and offer you solutions. Our policy is to provide personal, one-on-one service, throughout the entire process. Your calls and questions are our primary concern and your comfort during the process is our mission. When you are searching for a Scottsboro, Alabama bankruptcy attorney with experience, look no further than the Law Firm of Ferguson & Ferguson. We know bankruptcy! Ferguson & Ferguson’s experienced Scottsboro bankruptcy attorneys will help protect your rights and property. If creditors are bothering you at work, harassing your family, friends and neighbors, or calling at all hours, you can put an end to it immediately simply by hiring Ferguson & Ferguson. Our Scottsboro, Alabama bankruptcy lawyers can keep creditors at bay and help clients keep their home, vehicles and other property. Our Scottsboro, Alabama bankruptcy attorneys are committed to providing clients with immediate debt relief and with assistance in starting over.

What Can Bankruptcy Do For Me?

Bankruptcy laws allow individuals such as yourself, the opportunity to eliminate debts caused by past mistakes or unforeseen circumstance. Assuming you need to file a bankruptcy, the only way to determine which Chapter to file under is to first compare your options under the other available Chapters (with the assistance of a bankruptcy attorney). Chapter 7 and Chapter 13 bankruptcies are the most common consumer bankruptcy types. Chapter 7 bankruptcy involves liquidation and distribution of assets to creditors. Chapter 13 bankruptcy involves rehabilitation and government protection. Generally, Chapter 7 is the cheapest, quickest and least burdensome of the three major Chapters (the others being 11 and 13) of bankruptcy law. Costs and fees vary depending on the number of creditors you have, complexity of your case, and other factors. Bankruptcy can help you prevent foreclosure of your home, stop debt collector harassment and get a fresh financial start.

Chapter 7 Bankruptcy in Alabama

Chapter 7 Bankruptcy is a process which allows individuals to eliminate, or discharge, all, or some, debt in a legal and orderly fashion. Chapter 7 bankruptcy (Title 11 of the United States Bankruptcy Code) is commonly known to attorneys, lawyers, and others as a liquidating bankruptcy (liquidation), personal bankruptcy, or just plain “bankruptcy.” It is also referred to as consumer, although businesses can also file under Chapter 7.

Under any Chapter, you are required to list all of your assets and all of your debts on your petition. An asset is anything you own or may have a right to own at some future date (for example, if you are in someone’s will). Some (and in many cases, all) of your assets will be exempt. Basically, you can exempt any items normally used for your support and maintenance, such as clothing, furniture, household goods, and so forth. After you file your case, a Trustee is appointed. He (or she) will liquidate (sell) all of your non-exempt assets and pay your creditors according to the priority afforded to them by the Bankruptcy Code. You may voluntarily repay any debt upon agreement with the creditor. Whether this is ever advisable is questionable and is an issue to be discussed with your attorney or lawyer.

The goal of most any personal bankruptcy attorney is to obtain a discharge or “bankrupt” their client’s existing debts and to allow them a fresh start on their finances. Technically, the word “bankrupt” is not the correct terminology when referring to getting rid of debts, but most people (even many attorneys) use that phrase. The correct legal term is “discharge”. You discharge your obligation to pay on debts. In other words, once your discharge is granted, you no longer need to repay the debts that were incurred before you filed your bankruptcy. Your creditors are entitled to share in the proceeds obtained from the liquidation of your non-exempt assets. Under Chapter 7, the amount your creditors will get is fixed by the value of your non-exempt assets. See Chapter 7.

Chapter 13 Bankruptcy

Chapter 13 is called the wage earner’s plan and allows people with a regular income to develop a plan for repayment of debt. Even people who are self-employed can file for Chapter 13. The goal of most any personal bankruptcy is to discharge your existing debts by repaying all or a portion of your debts, and allow you a fresh start on your finances. In other words, once your discharge is granted, you no longer need to repay the debts that were incurred before you filed your bankruptcy.

When someone files for bankruptcy under Chapter 13 of the Bankruptcy Code, their aim is to have the opportunity to repay some or all the debts in their name, in better terms, i.e. lower or no interest. Unlike Chapter 7 which involves liquidation of assets, this process involves restructuring debts which allows the debtor to use whatever income they may have in the future to pay off the creditors. Filing Chapter 13 Bankruptcy is thus applicable for a debtor who has a regular income, but desires to repay their creditors but are in financial difficulty. The maximum amount of time to pay back creditors is 5 years. Among other things, it offers great opportunities to pay off past due mortgage arrearages or car payments over 36-60 months, giving you time to catch up and keep your property. It is often referred to as a “mini-Chapter 11” by many bankruptcy attorneys and lawyers because you usually repay something to your creditors and you retain your property and make payments under a Plan. Chapter 13 can help you protect and keep all your assets, stop foreclosure sales and catch up on past due mortgage payments over time, remove liens, such as second mortgages, on your property, discharge unsecured debts (such as credit cards, medical bills, certain taxes, and more) by doing an affordable repayment plan from 0%-100% and repay debts with zero percent interest.

How Can We Help?

The first step to filing a successful Chapter 7 Bankruptcy is to accurately evaluate one’s goals, and one’s eligibility for Chapter 7 Bankruptcy relief. The objective of the typical Chapter 7 Bankruptcy filer will be to eliminate all, or some, of his or debt. Whether or not one is eligible to file is a different issue than whether or not one should file. The person contemplating a Chapter 7 Bankruptcy must first assess whether or not he or she is eligible to file. Requirements are relatively easy. Currently, the requirements are that you have not filed for Chapter 7 Bankruptcy in the previous eight years or a Chapter 13 Bankruptcy that paid less than a 70% dividend to unsecured creditors in the previous six years. In fact, a person filing for chapter 7 need not be a citizen or even a legal resident of the United States, the Code requires that the debtor simply must be a “resident.” If you meet these simple factors, then you would be eligible to file a chapter 7.

What YOU get when you choose Ferguson & Ferguson:

- Free phone consultation 7 a.m. to 7 p.m. and Saturdays

- Free office consultation as late as 7 p.m. and Saturdays also

- Fast filing same day available

- Locations near you

- No money down filing available for Chapter 13 plans

- Payment plans you can afford available to fit your case

- No hidden charges: some firms tack on $150 for what we do for free

- Established bankruptcy law firm and staff.

- We do both Chapter 7 and 13, some attorneys only do one Chapter.

- We are in court all the time everywhere, it’s no trouble to help you out!

- No phony debt settlement schemes: we work within the court system

- Personal attention, happy clients, and a fresh start for you

- Experience counts: we do so much bankruptcy we see everything

- Lawyers and staff who are up to date on current bankruptcy laws!

Free Bankruptcy Consultation

If you are having financial problems, we are here to help. Your case deserves personal attention from an experienced attorney and staff. Our seasoned Scottsboro bankruptcy lawyers have been representing Scottsboro residents for many years. Our successful case results and satisfied past clients are a testament to our experience and commitment to our clients. Together, Ferguson & Ferguson attorneys have more than 40 years of collective experience representing clients in Scottsboro, Alabama. If you are a consumer facing foreclosure, liens, lawsuits, repossession or wage garnishment, our experienced bankruptcy lawyers can find the best option to help eliminate your debt. Our lawyers keep abreast of ever-changing federal bankruptcy laws and provide our clients with the best, most current advice. Call Ferguson &Ferguson now for a free no obligation consultation with one of our Scottsboro, Alabama bankruptcy attorneys. Call now 256-534-3435 or 1-800-752-1998.

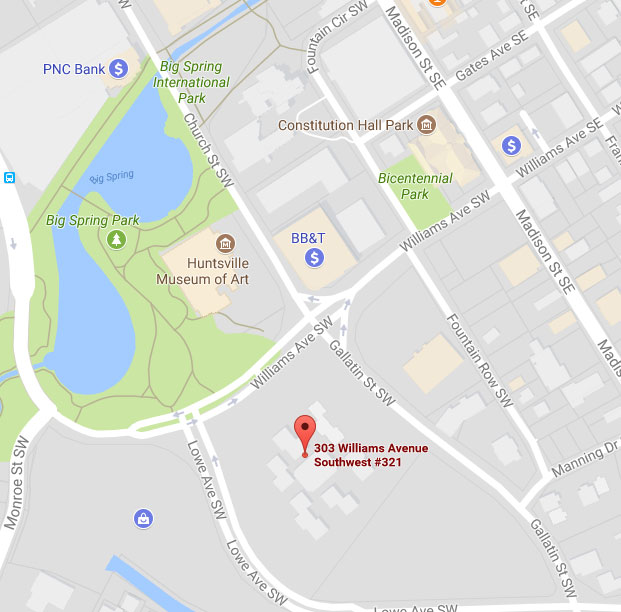

Huntsville Office Location:

303 Williams Avenue SW

Suite 321

Huntsville, AL 35801

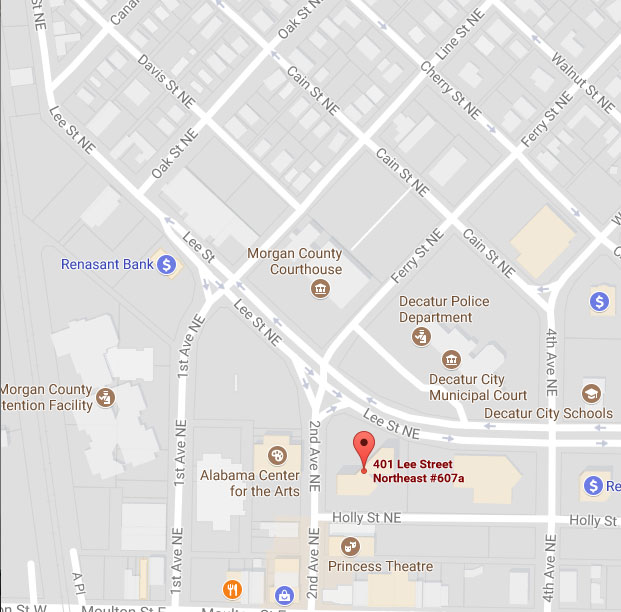

Decatur Office Location:

211 Oak Street

Decatur, AL 35601