TIMELINE FOR CHAPTER 13 BANKRUPTCY IN ALABAMA

One of the worst outcomes when confronting financial challenges is bankruptcy, according to popular belief. But declaring bankruptcy can be a calculated action that aids in bringing order to your financial situation.Which chapter of the Bankruptcy Code to file under is one of the first choices you must make when declaring bankruptcy.

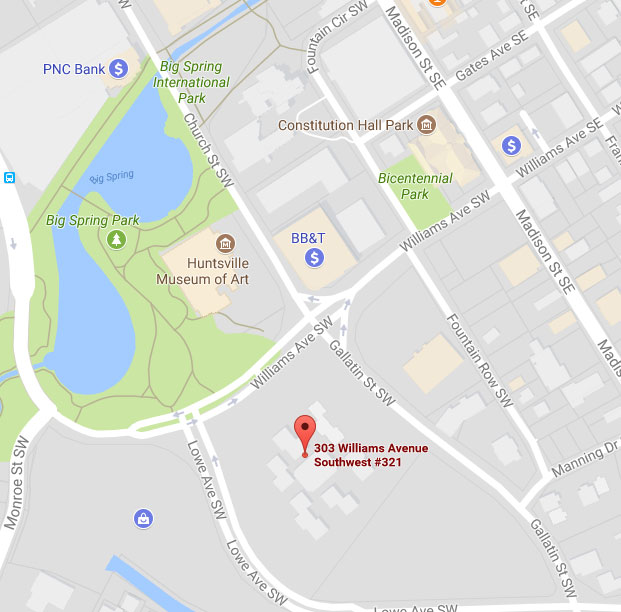

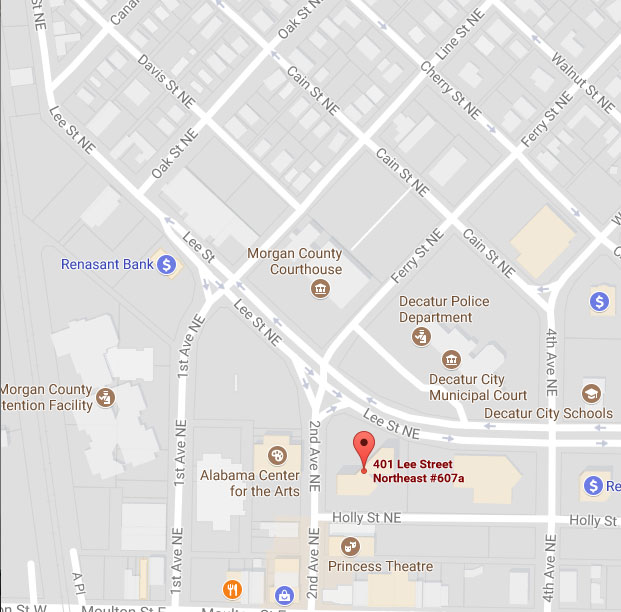

Chapter 7 or Chapter 13Chapter 13 bankruptcy is the most common type of bankruptcy filed by people in Alabama. Chapter 7 bankruptcy (Title 11 of the United States Bankruptcy Code) is commonly known to attorneys, lawyers, and others as a liquidating bankruptcy (liquidation), personal bankruptcy, or just plain “bankruptcy.” In a Chapter 13 bankruptcy, payments are made over a five-year maximum period in accordance with a plan approved by the bankruptcy court. If you are considering a Chapter 13 bankruptcy in Athens, Cullman, Decatur, Huntsville, Moulton or Scottsboro, Alabama, read below how the process works and if it is in your best interest. If you have questions, call for your free consultation at our Decatur or Huntsville office.

How Long Is the Process to File for Chapter 13 in Alabama?

How long it takes to prepare a Chapter 13 case varies depending on the circumstances and can range from hours to years. All cases are different, and it depends on what you are trying to accomplish with your chapter 13 bankruptcy. If you are trying to stop a foreclosure on your home or stop a repossession of your automobile, you must file the bankruptcy as soon as possible. An emergency petition can be filed with basic information and a list of creditors, or the case can be filed with all the schedules and statements and plan.

If an emergency plan, also called a “skeletal” petition is filed, then the debtor is given 14 days to submit the schedules and statements. The schedules and statements require a disclosure of many items including assets and debts and a statement of financial affairs which reviews prior purchases, transfers and transactions that occurred over months and years. Prior to filing a bankruptcy case, it is necessary for the debtor to take an internet based counseling course, which generally takes 45-90 minutes.

What Happens After I’ve Filed for Chapter 13 Bankruptcy?

Once you have filed your Chapter 13 bankruptcy petition in court, an automatic stay will go into effect. The automatic stay stops any collection efforts by your creditors, including repossessions, foreclosures, wage garnishments, and lawsuits. This period of time gives you some relief from the pressure of your lenders pursuing actions against you while the bankruptcy court evaluates your petition.

- We submit a repayment plan— The plan will propose a monthly payment, describe which of your debts will be paid under the plan, and detail how much your creditors will be repaid.

- Take a credit counseling and financial management course— You must finish the course from one of the approved agencies before your debts can be discharged.

- Attend the 341 meeting of creditors — You must attend a meeting of creditors. Since COVID started, the meetings have been held by phone. At the meeting you will be asked number questions. We will go over all of the questions before the hearing.

- Get the the plan confirmed — The bankruptcy court will hold a plan confirmation hearing if the trustee or any creditors object to proposed repayment plan. At the confirmation hearing, the bankruptcy court decides whether to sustain or overrule the objection. The bankruptcy court has the power to deny confirmation even in the absence of an objection. However, the bankruptcy court is only permitted to deny confirmation for a certain number of reasons. The confirmation generally occurs 3-6 months after the case is filed in court.

The Bankruptcy Process includes the following:

How Long Does My Chapter 13 Bankruptcy Case Last?

A Chapter 13 repayment plan can last up to five years from the date of plan confirmation, depending on your income, payments and the amount of your debt. During this time, you will need to send regular payments as described by the approved plan to the bankruptcy trustee. The trustee will then distribute the money to your creditors under the plan’s payment terms. During this time if you were to come into any other money like a personal injury case or inheritance, you must notify your attorney and the bankruptcy court.

As long as you comply with the terms of the plan, any balances on any debts that can be discharged left over at the end of the plan term will be discharged. You will no longer have any responsibility for those debts. However, your Chapter 13 bankruptcy will stay on your credit report for seven years after the filing date. There are ways to improve your credit score after filing a bankruptcy.

Free Chapter 13 Bankruptcy Consultation

If you are considering filing for Chapter 13 bankruptcy in north Alabama, make sure you hire an experienced bankruptcy attorney to help you navigate the bankruptcy process. Contact our office 24/7 for a free consultation with one of our bankruptcy lawyers. Call 256-534-3435 or 256-350-7200.