REAFFIRMATION AGREEMENTS IN BANKRUPTCY

If you are behind on car or mortgage payments in Alabama, and you want to keep the property after filing a Chapter 7 bankruptcy, you may consider a reaffirmation agreement. By reaffirming the debt you owe, you are able to keep your vehicle or personal property recently purchased, provided you are able to make the payments. Since home mortgages and car loans are considered secured debt, if you have defaulted on your payments, the lender can take the property from you. With a vehicle, it is referred to as repossession. With a home, it is a foreclosure action. By reaffirming the debt, you are essentially promising the lender that the debt will not be discharged in bankruptcy. It involves entering into a new contract with the creditor for the remaining amount due.

Should I Sign a Reaffirmation Agreement?

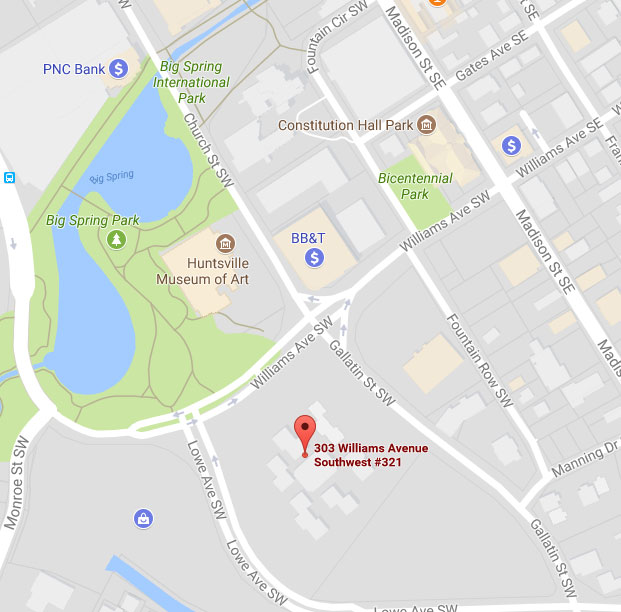

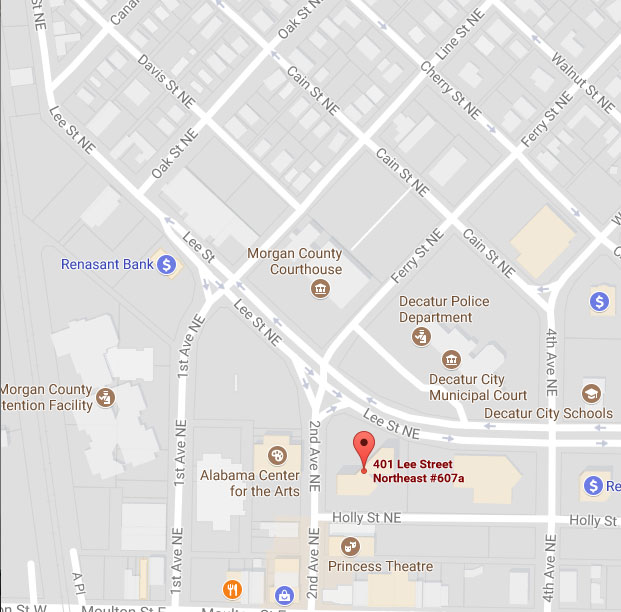

If you wish to keep your house or vehicle, you may need to sign a reaffirmation agreement. However, it is important that you understand that entering into that contract will make you personally liable for that debt, despite your bankruptcy relief. Therefore, it is critical that you can afford the payments established in the new creditor payment plan. Reaffirmation agreements only apply if you file a Chapter 7 bankruptcy, not a Chapter 13 bankruptcy. To determine if you are eligible for Chapter 7 bankruptcy, you must pass the means test. If you are considering a reaffirmation of these debts, talk to an attorney now. Call 256-534-3435 or 256-350-7200. We are here to help.