ELIMINATING MEDICAL BILL DEBTS THROUGH BANKRUPTCY

Are you getting daily calls about overdue medical bills or liens from doctor’s offices, Avectus, Huntsville Hospital or Decatur Morgan Hospital? Have you incurred substantial medical bill debt? Hospitals, clinics, and other health care providers are focused on collecting payment. In addition to calling you and sending threatening letters, they can file a lawsuit with the goal of obtaining a judgment against you. A judgment may allow them to garnish your wages, freeze your bank accounts and more. It may surprise you to learn that next to credit card bills, medical expenses are one of the leading causes of bankruptcy. We can help you file either Chapter 7 or Chapter 13 bankruptcy, giving you a chance to get back on your feet again.

What Happens to Medical Bills in Bankruptcy?

Whether you have a sudden illness, medical coverage lapse, or you needed a medical procedure that was not covered by insurance, you have options for taking care of the medical debt. When you file Chapter 7 bankruptcy, most medical bills will be completely eliminated. With Chapter 13 bankruptcy, you will pay what you can afford over three to five years. At the end of the designated time, any remaining medical debt is discharged.

Free Bankruptcy Consultation

If you are having financial problems, we can help. Call now for a no obligation, free consultation with one of our Decatur or Huntsville bankruptcy attorneys. To learn how we can help you eliminate all your past medical bills, call 256-534-3435 or 256-350-7200.

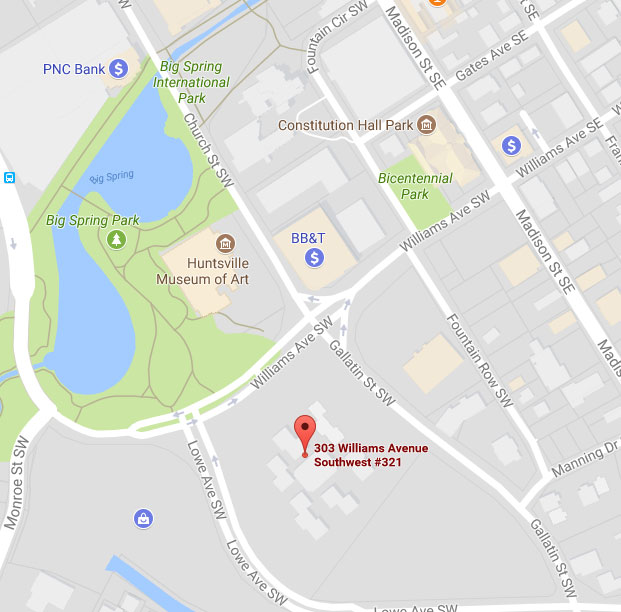

Huntsville Office Location:

303 Williams Avenue SW

Suite 321

Huntsville, AL 35801

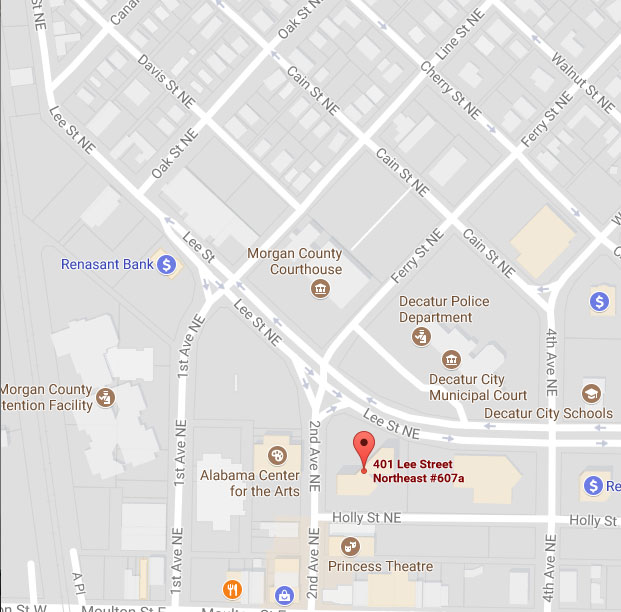

Decatur Office Location:

211 Oak Street

Decatur, AL 35601