HOW TO FILE FOR BANKRUPTCY IN HUNTSVILLE ALABAMA

Are you considering filing bankruptcy? Do you have questions on how it works? Do you want someone to explain the process to you in a simple straight forward way? There are a number of choices you must make before you file bankruptcy in Alabama. The first thing you must decide is if you want an attorney to represent you or will you attempt to represent yourself in your bankruptcy case. Below are the steps that you need to take regardless of whether you represent yourself or you are represented by an attorney. Call us now for a FREE CONSULTATION, to determine if you want to handle your bankruptcy case yourself. Call 256-534-3435. We can help make the process much easier. If you handle your bankruptcy case yourself or not, you should:

1. Gather Necessary Documents -The documents you will need to gather to complete your paperwork include

- 6 months of Paystubs or Other Income Verification – If you are unemployed or have other income then you should have that this information to complete your documents

- Creditor Information – Gather information on all of your creditors that you currently owe money to. You will need to have available their addresses and the estimated amount that you owe to your creditors. One option is to pull your credit report to review what you owe to who.

- Asset Information- Gather documents that provide information on any assets you have including bank accounts, whole life insurance policies, IRA, 401K, Retirement, Vehicle Value (Edmunds, Kelley Blue Book value, or NADA)

- Last 2 years of Filed Tax Returns if filing a 7 and 4 years are generally required for Chapter 13 bankruptcy cases.

If you are represented by a bankruptcy attorney they will also request that you gather these documents and provide them to their office. These documents are needed to complete your bankruptcy schedule and petition.

2. Complete a Credit Counseling Class – You need to complete a credit counseling class prior to filing your bankruptcy case. The class is approximately 1.5 hours long and generally can be done over the phone or internet.

The credit counseling class must have been completed within 6 months of filing. It is important that you do not complete the class until you are ready to file. If your credit counseling certificate expires then you will need to retake your class. Once you complete the course you will be issued a certificate that you will need to file in your bankruptcy case.

3. Complete Petition & Schedules – You will need to complete a petition and schedules and file them with the court. The court in which you need to file your petition and schedules will generally depend on where you have lived in the last 180 days.

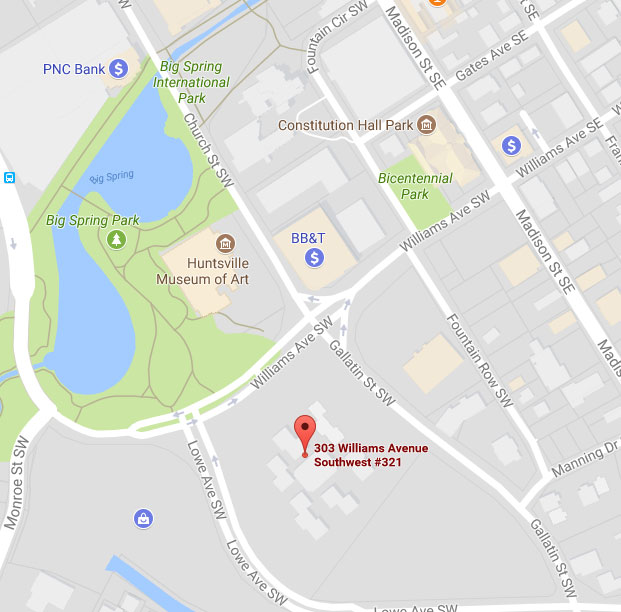

If you are represented by an attorney then the attorney will fill out the documents and schedules and review the information with you. The attorney will then file the documents with the appropriate bankruptcy court. If you are representing yourself, then once you complete the petition and schedules you will need to file them at the bankruptcy court. When filing your bankruptcy documents you should attach to the Debtor's Certificate of Employment Income, your last 60 days of paystubs.

4. Provide the Trustee with Tax Returns – You will need to mail the trustee that has been assigned to your case your last 2 years of filed federal and state tax returns. If you are filing a Chapter 13 bankruptcy then you should provide them with the last 4 years of state and federal tax returns. If you have not filed tax returns for several years, then provide the trustee with the last filed federal and state tax return. Provide a full copy with all of the schedules and forms that were completed as part of the tax returns. Do not send only the beginning pages of the tax return.

If you are represented by an attorney then the attorney will generally complete this process. They should ensure that the assigned trustee receives your tax returns.

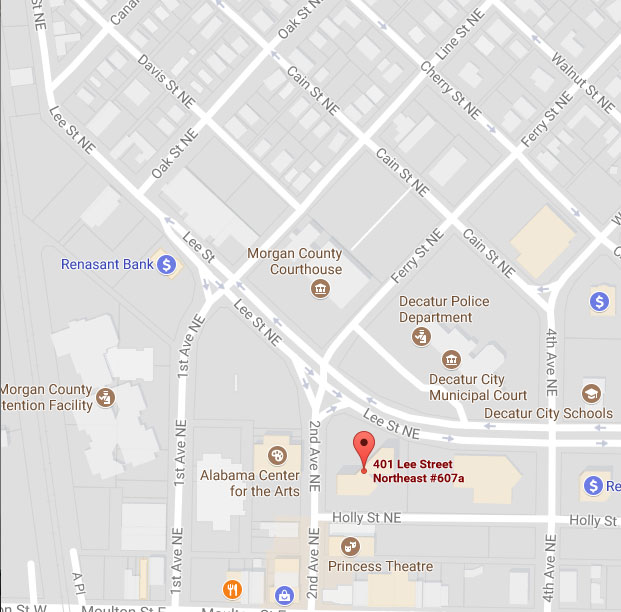

4. Attend 341 Hearing – After your bankruptcy case is filed you will have a 341 hearing scheduled. You will need to attend the 341 Hearing and bring proof of social security and identification. The trustee will ask you questions in regards to the documents and schedules that you have filed with the court. The questions that the trustee will ask you about will pertain to your assets, creditors, and income. The majority of these questions will require a yes or no response. In most cases, the questioning should be completed within 5 minutes.

If you are represented by an attorney then generally the attorney will be present with you at the 341 hearing. The attorney will walk you through the steps of your 341 hearing and should answer any questions or concerns you have about the 341 Hearing.

If you are concerned about the types of questions that the trustee will ask you at the 341 hearing then read our FAQ’S section.

5. Complete a Debtor Education Class – You will need to complete the second class after you file your bankruptcy petition and documents. Once the class is completed you will need to file a B23 form with the court that indicates that you have completed an approved Debtor Education Class.

If you have an attorney then they should generally file the B23 form with the court once you have completed the debtor education class.

This is just an outline of steps to take when filing an Alabama bankruptcy. Be aware that there are additional steps that you may need to complete depending on what Chapter of bankruptcy you are filing. If you decide to retain an attorney, call us any time for a no obligation FREE CONSULTATION. Call 256-534-3435. We can help.