THE BANKRUPTCY PROCESS IN ALABAMA

If you are having financial difficulties and are struggling with debt, you may be considering filing for bankruptcy. Do you have questions or concerns about the bankruptcy process? Some people avoid bankruptcy altogether because they think it is just too complex. Our Huntsville bankruptcy attorneys can make the process as straightforward and easy as possible for you. If you decide bankruptcy is right for you, our experienced Alabama bankruptcy attorneys will guide you through the process. Call 256-534-3435 now. We are here to help you through your financial problems.

The Chapter 7 Bankruptcy Process in Alabama

In a Chapter 7 bankruptcy, a trustee “ steps into the shoes of the debtor” for a short period of time. Assets that cannot be protected can be liquidated and The Trustee will make distributions to creditors. Keep in mind, the majority of Chapter 7 bankruptcies are “ no asset” cases, meaning the debtor’s assets are entirely exempt from being seized and liquidated. It is extremely important to obtain the proper bankruptcy attorney to protect what is important to you and your family.

Following is a general outline of what you can expect from the Chapter 7 bankruptcy process:

- We will review your financial situation, including looking at your last two months of pay stubs, credit reports, lawsuits against you and other details.

- If you decide bankruptcy is right for you, you will have to undergo a means test to determine if you qualify for Chapter 7.

- If you qualify, we can file the bankruptcy petition, enacting the automatic stay and stopping your creditors from taking further actions against you.

- You must attend a meeting with your trustee, which take place 30 to 45 days after filing.

- When your bankruptcy is successful, your debt is discharged after four to six months from the date of filing.

The Chapter 13 Bankruptcy Process in Alabama

If you file for Chapter 13 bankruptcy in Alabama, you face a completely different process. Debt is not discharged immediately in a Chapter 13 bankruptcy, but rather after the completion of a three- to five-year payment plan. All collection efforts are stopped by creditors. You and your attorney will propose a feasible payment plan to the bankruptcy court, based on a number of factors, including the amount and nature of your debt, your assets and your “disposable” income. You can even cure the arrears on your home and force the lender to cure the payments over 60 months. This can be accomplished for other secure debt as well including but not limited to your auto, tools of the trade and even IRS debt.

Filing for Chapter 13 immediately enacts the automatic stay, which protects you from home foreclosure, repossession, creditor harassment and other consequences of debt. Whether you file for Chapter 7 or Chapter 13 bankruptcy, our lawyers will guide you through every step of the process.

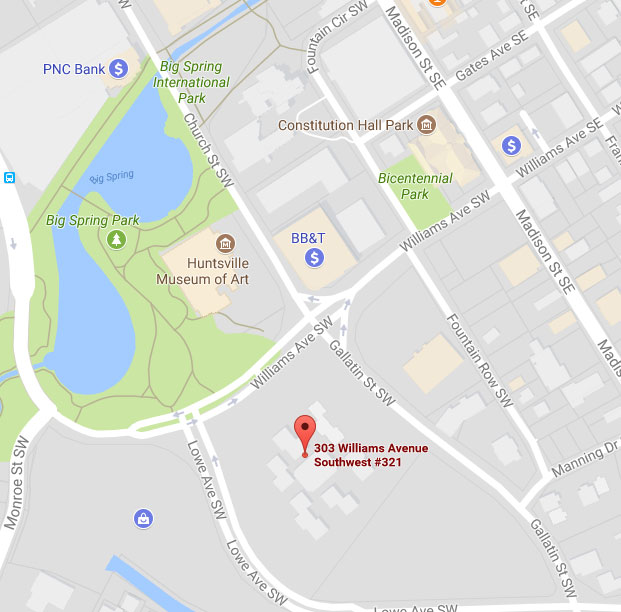

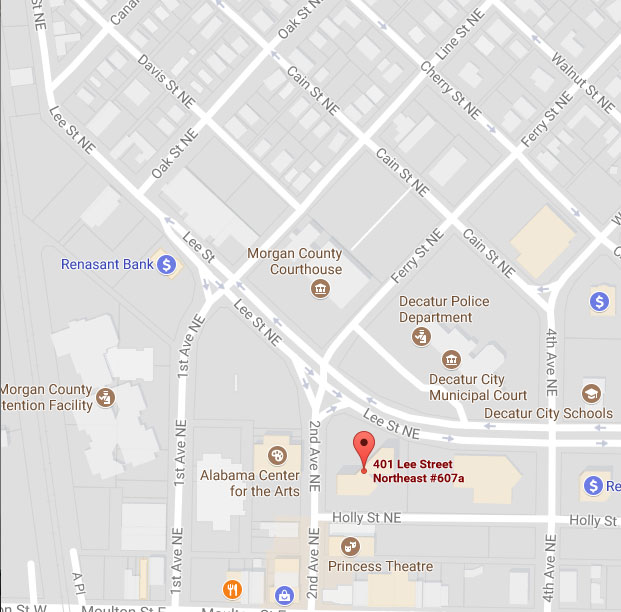

Contact Ferguson & Ferguson Now

For a free initial consultation about filing for bankruptcy, call 256-534-3435. We can help you through this difficult time. Call now. Call 256-534-3435.