Chapter 7 Bankruptcy Means Test

Are you considering filing a Chapter 7 bankruptcy in Huntsville, or Decatur, Alabama? Do you know that you have to pass a means test before you qualify to file a Chapter 7 bankruptcy? Do you know what a means test is and its purpose? The bankruptcy “means test” determines whether your income is low enough for you to file for Chapter 7 bankruptcy in Alabama. It’s a formula designed to keep high wage earners from filing for Chapter 7 bankruptcy.

When determining whether you qualify for Chapter 7 bankruptcy in Alabama, the means test compares your average gross monthly income for the six-month period before filing to the median income of similar households in Alabama. If you’re a low-income filer, you’ll likely qualify for Chapter 7 bankruptcy based on your gross income alone. You’ll automatically pass if your income is below the state median. The means test presumes that low-income debtors can’t pay back creditors and therefore, aren’t abusing the system by filing for Chapter 7 bankruptcy. However, if your income is above the median, you don’t automatically fail, either. You’ll complete the rest of the means test and subtract allowed expenses from your gross income. If the amount that remains isn’t enough to make a meaningful payment to your creditors, you’ll still qualify for a Chapter 7 discharge.

Who Must Take the Means Test?

Median income only determines whether you have to take the means test to qualify for Chapter 7.

- Families with income below the median income in their state automatically are allowed to file.

- Families with income above the median have to take the test. Pass the test, and you are free to file Chapter 7.

How the Means Test Works

The means test looks at your income for the purposes of Chapter 7 within two different time periods. First, the means test measures the total “regular” income received in the six months prior to the Chapter 7 bankruptcy filing and averages that income (less social security types of income). Second, the “present day” income that exists on any given day during the administration of the Chapter 7 bankruptcy case is also taken into account. The means test examines financial records, including income, expenses, unsecured and secured debt. If your annual income, for a family of your size is below the median for your state, you are free to file a chapter 7 or 13 bankruptcy. If your annual income is above median, you have to apply the means test formula for comparing future expenses against that historic income. If you have enough disposable monthly income to pay back unsecured creditors, you won’t qualify for Chapter 7 bankruptcy in Alabama.

Even if you make too much money to pass the Chapter 7 means test, you might still be able to qualify for Chapter 7 bankruptcy. If that formula says that you have $208 a month in discretionary income, then a Chapter 7 case is presumed to be an abuse of bankruptcy law, although that presumption is rebuttable. If you “fail” The Means Test, then there is a presumption that you do not qualify for Chapter 7, and now the burden of proof is on you to demonstrate that you do qualify for Chapter 7.

The worst part of the means test is it seems to favor people with big mortgages, car loans, unpaid child support and back taxes. Those debts are all deductible on the means test. It’s the folks with upper middle class incomes who pay their rent, taxes, and drive cars that are paid for that are disadvantaged by the means test. If you have a high income, your expenses must also be high to pass the means test. Every state has different income limits to qualify. You might be forced to sell some non-exempt assets, although important assets like cars, homes, and work equipment are exempt and can be retained.

Expenses That Might Help on the Means Test

The most common obligations you can deduct from your actual expenses on the means test includes the following:

- Healthcare costs.

- Involuntary deductions.

- Health, disability or term life insurance costs.

- House, car, and other secured debt payments.

- Court ordered payments.

- Child care.

- Taxes.

- Education for employment or a disabled child.

- Charitable contributions.

- Care of a elderly person, chronically ill or disabled.

- Expenses for special circumstances.(natural disasters)

Other Necessary Expenses

In the “” Other Necessary Expenses” portion of the form, you deduct future expected, unreimbursed health care expenses for you and your family. The following are possible expenses that you haven’t been paying because of your financial troubles.

- Co pays for doctor visits.

- Eye glasses and contacts.

- The insurance policy deductible for your family.

- Lab tests and screenings.

- Orthodontic treatment.

- Physical therapy.

- Eye exams.

- Prescriptions drugs.

- Routine dental exams.

- Needed dental work.

- Other procedures.

- Mental health needs.

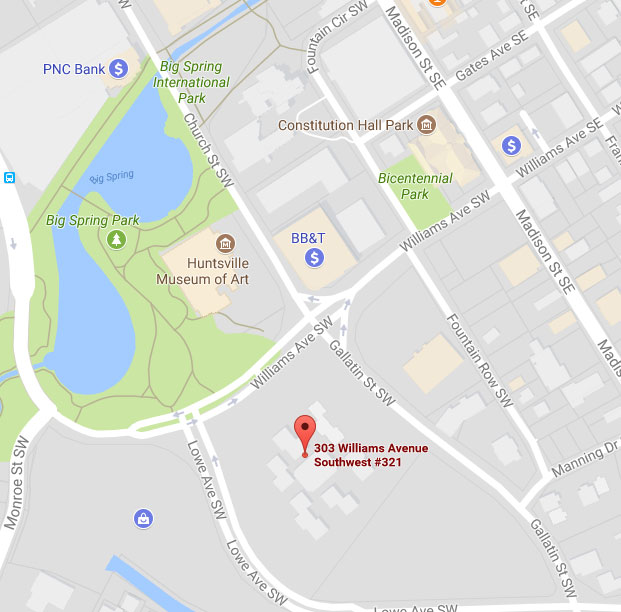

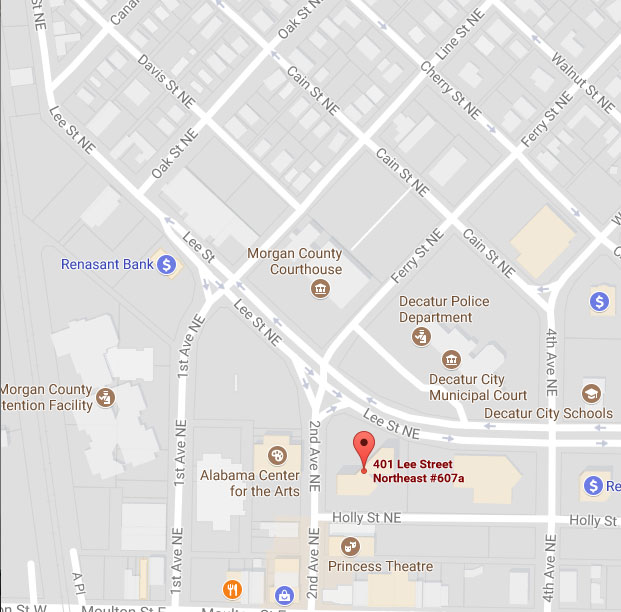

Why Hire Ferguson & Ferguson?

Being over the median income is not an automatic bar to filing Chapter 7 bankruptcy. It simply means you need a very experienced bankruptcy attorney who can crunch the numbers so that you have a choice about which chapter of bankruptcy to file. If you need an experienced bankruptcy attorney in North Alabama, call 256-534-3435. We can help.