BANKRUPTCY MYTHS AND LIES

Many people avoid filing for bankruptcy, because of incorrect information they have received from friends and family. This misinformation usually stops people from seeking the assistance of an Alabama bankruptcy lawyer who can help them understand how bankruptcy can help their situation. Below is a list of common concerns and myths that stop many people in Alabama from seeking the help of a bankruptcy attorney. If you have questions, call 256-534-3435 now.

Bankruptcy Concerns

1. Can I keep my home if I file for bankruptcy?

If are current on your mortgage payments and there is no equity in your home, then generally you can keep your home when you file for bankruptcy. If you are behind in your mortgage payments then Chapter 13 bankruptcy may be available to help you catch up on your payments and keep your home.

Even when your home has equity in most instances the equity can be protected in a bankruptcy and you can keep your home.

2. Can I keep my car if I file for bankruptcy?

If you are making payments on your vehicle, in most instances as long as you continue to make your payments on your vehicle and sign a reaffirmation agreement, you will generally get to keep your vehicle. If your vehicle is paid in full, in most circumstances we can protect the equity in your vehicle.

3. Will my credit be ruined for the next 10 years if I file for bankruptcy?

Although a Chapter 7 and 13 can legally remain on your credit report for 10 years, this does not mean that your credit will be ruined for the next 10 years. In as little as 20 months from the time your debts are discharged, your credit rating can improve. Most people are able to get their credit score to a good level, after 3 years

4. Will my clothes, furnishings, and household goods be taken away if I file?

In most cases, you can keep your house, your car, and most or all of your personal possessions. Filing bankruptcy can protect those assets while reducing or removing your debts from your shoulders. In the majority of cases, your household goods and furnishings will not be touched by the bankruptcy court or your creditors. These items are generally protected by Alabama bankruptcy exemptions which stop creditors from using these items to satisfy the debts.

5. If I file for bankruptcy and get a discharge, will they be able to ask for payment in the future?

If you provided accurate and non-fraudulent information on your bankruptcy petition and obtained a discharge from the bankruptcy court, then creditors cannot seek to collect on any debts that were discharged in the bankruptcy case, once the case is closed.

6. Will I be able to obtain credit after I file?

Most people have no problems obtaining a credit card after filing for bankruptcy. In fact, there is an industry of companies that cater specifically to extending credit to people who have filed for bankruptcy.

7. Is it unethical and immoral file for bankruptcy?

Federal bankruptcy law was created specifically to help people in situations where they cannot afford to pay their debts back. There is nothing unethical or immoral about using the federally established law to legally eliminate your debts. In fact, it shows good character, that you are willing to take action to resolve your financial situation.

8. I will not be able to purchase a home if I file for bankruptcy?

Generally most individuals who have filed for Chapter 7 bankruptcy, are able to qualify to purchase a home after 3-4 years. In Chapter 13 bankruptcy you will have to seek the permission of the court if the bankruptcy case is still pending.

9. I recently moved to Alabama, do I have to file for bankruptcy in the state I moved from?

Federal venue rules allow you to file for bankruptcy where you have resided for the greater part of the 180 days prior to filing for bankruptcy. This means that you can have resided in Alabama for as little as 91 days and you can file for bankruptcy in the Alabama.

10. Because the bankruptcy laws have changed, filing for bankruptcy is no longer an option for me.

That myth is not true. Bankruptcy is still available for most people. Although the laws did change, complete debt relief under Chapter 7 is still possible for many people. If you don’t qualify for Chapter 7, you may still be able to reduce or remove your debts under Chapter 13.

11. Bankruptcy is an expensive and complicated process.

That is not true. Our firm does everything possible to make the process easy. Our flat fee makes it simple and convenient. We file all necessary papers, and immediately stop foreclosure, repossession, and creditor harassment. Our bankruptcy attorneys will take care of everything and keep you informed throughout the process.

12. Filing for bankruptcy puts you at the mercy of creditors.

Not true. Bankruptcy can actually increase your options by reducing or eliminating unsecured debts and allowing you to take control and begin making orderly payments on your remaining debt. In some cases, you can actually choose which debts are discharged.

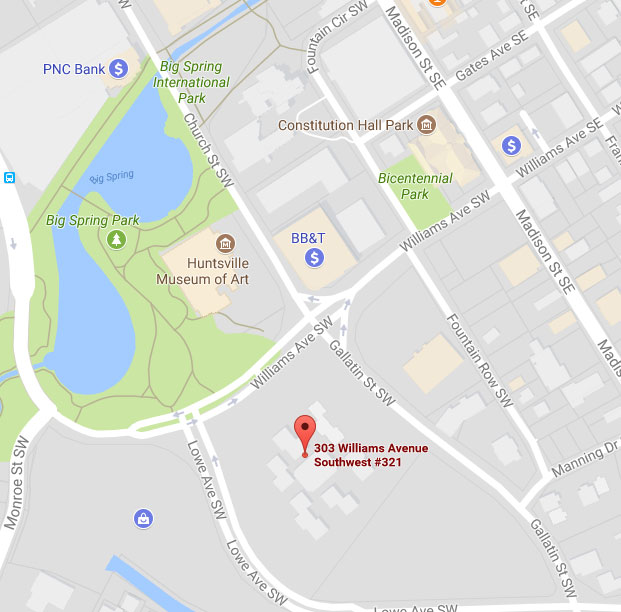

Huntsville Office Location:

303 Williams Avenue SW

Suite 321

Huntsville, AL 35801

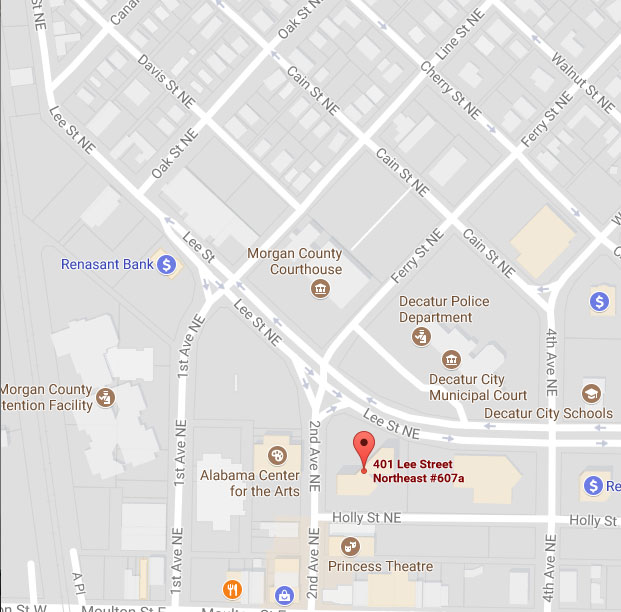

Decatur Office Location:

401 Lee Street, Suite 607A

Decatur, AL 35601