THE TRUTH ABOUT CREDITORS AND BANKRUPTCY

The credit industry wants to discourage you from filing bankruptcy. In an effort to collect on debts, creditors can be aggressive, rude and frequently try to frighten hardworking people.

Did You Know?

- A majority of individuals who file for bankruptcy do not lose any of their belongings — Creditors would like you to believe that if you file bankruptcy, you will lose your house, your car, and all your personal belongings. The truth is that a majority of petitioners retain all their property.

- After you file bankruptcy, creditor harassment must stop— Once you file, an automatic stay goes into effect, prohibiting creditors from contacting you.

- You have the power to stop a home foreclosure — Filing bankruptcy halts all foreclosure actions, giving you room to breathe.

- You can rebuild your credit — Once your debt is discharged, you will be able to work on repairing your credit score. Many people get approved for a secured credit card or loan within a year after filing bankruptcy. You may even have the ability to avoid high interest rates.

- Most people filing bankruptcy are good people who have fallen on hard times — The credit industry would like you to believe that only deadbeats file bankruptcy. However, a large number of petitioners got into financial trouble because of job loss, divorce or unforeseen medical expenses.

- Bankruptcy offers the best solution to obtain a fresh start after suffering from a financial hardship — Bankruptcy is usually a one-time, one-fee proposition. Your fresh start begins immediately after filing bankruptcy in Alabama.

Ferguson and Ferguson Can Help

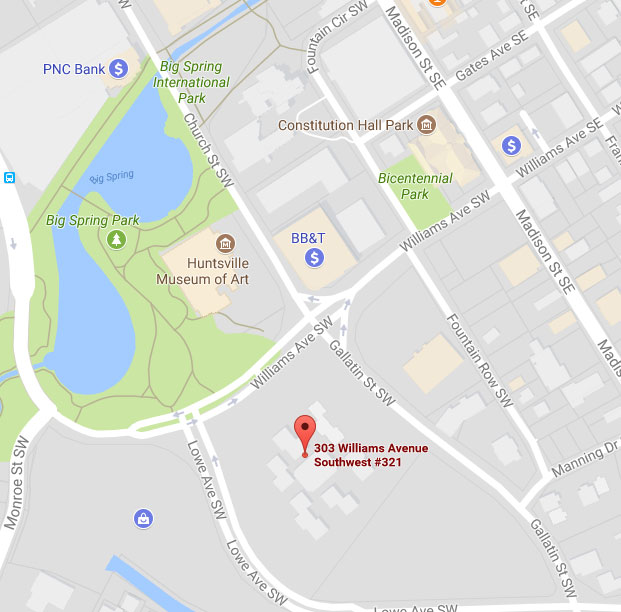

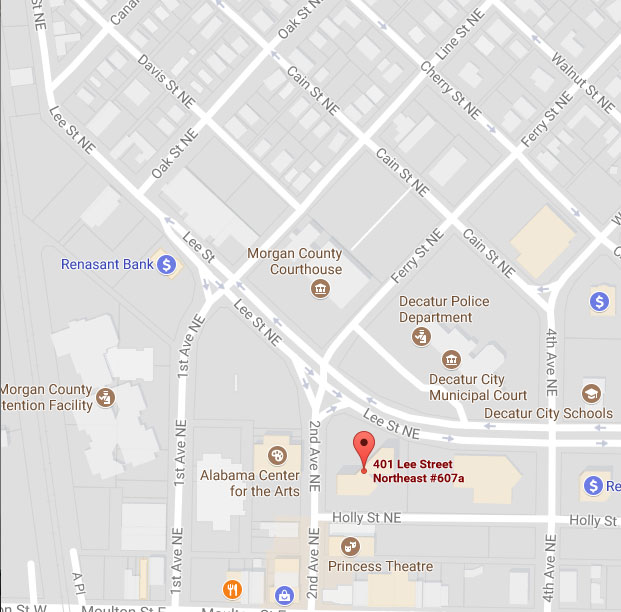

To learn more about bankruptcy and how the process works, come in today for a free consultation with one of our experienced bankruptcy attorneys. Call 256-534-3435. We are here to help.