Chapter 7 Bankruptcy Attorneys in Decatur AL

Are you receiving endless calls from creditors? Are the bills piling up? Are you considering bankruptcy? When you’re falling behind with credit card debts and creditors are calling – it feels great to know that there’s a debt program to lower your payments and get you out of debt much faster than you ever imagined. Chapter 7 Bankruptcy is a process which allows individuals to eliminate, or discharge, all, or some, debt in a legal and orderly fashion. Although the end result is simple, the elimination of debt, the process can be tricky and fraught with many pitfalls. To ensure success, the Chapter 7 Bankruptcy filer must be keenly aware of not only the ultimate goal but also all of the law’s requirements. Call Ferguson & Ferguson now. We offer FREE consultations on all bankruptcies. We are here to help. Call 256-534-3435 or 256-350-7200.

Chapter 7 bankruptcy (Title 11 of the United States Bankruptcy Code) is commonly known to attorneys, lawyers, and others as a liquidating bankruptcy (liquidation), personal bankruptcy, or just plain “bankruptcy.” It is also referred to as a consumer, although businesses can also file under Chapter 7. For cases filed after October 17, 2005, eligibility to file Chapter 7 is partially determined by a means test if your annual income exceeds the median income for your geographic area as determined by the IRS. Currently, the median income in Alabama is $38,321 for a single-person household, $46,025 for a household of two people, and more for larger families. If your average income during the six months before you file is more than the median income for a family of your size in Alabama, you may not be allowed to use Chapter 7, depending on your income and debts. It may be that you can qualify easier now under the new law and the means test, than you could have under the old law, where judges had no fixed formula.

Under any Chapter of bankruptcy, you are required to list all of your assets and all of your debts on your petition. Although most of bankruptcy is governed by federal law, some aspects of bankruptcy are controlled by state law. For example, all states have a set of exemptions that determine, in part, what property you get to keep in Chapter 7 bankruptcy. An asset is anything you own or may have a right to own at some future date (for example, if you are in someone’s will). Some (and in many cases, all) of your assets will be exempt. Basically, you can exempt any items normally used for your support and maintenance, such as clothing, furniture, household goods, and so forth. After you file your case, a Trustee is appointed. He (or she) will liquidate (sell) all of your non-exempt assets and pay your creditors according to the priority afforded to them by the Bankruptcy Code. You may voluntarily repay any debt upon agreement with the creditor. Whether this is ever advisable is questionable and is an issue to be discussed with your attorney or lawyer.

The goal of most any personal bankruptcy attorney is to obtain a discharge or “bankrupt” their client’s existing debts and to allow them a fresh start on their finances. Technically, the word “bankrupt” is not the correct terminology when referring to getting rid of debts, but most people (even many attorneys) use that phrase. The correct legal term is “discharge”. You discharge your obligation to pay on debts. Throughout this webpage, that is the term that will be used to describe getting rid of (bankrupting) debts in bankruptcy. In other words, once your discharge is granted, you no longer need to repay the debts that were incurred before you filed your bankruptcy. Your creditors are entitled to share in the proceeds obtained from the liquidation of your non-exempt assets. Under Chapter 7, the amount your creditors will get is fixed by the value of your non-exempt assets.

How Can Ferguson and Ferguson Help?

The first step to filing a successful Chapter 7 Bankruptcy in Huntsville or Decatur, Alabama is to accurately evaluate one’s goals, and one’s eligibility for Chapter 7 Bankruptcy relief. The objective of the typical Chapter 7 Bankruptcy filer will be to eliminate all, or some, of his or debt. Whether or not one is eligible to file is a different issue than whether or not one should file. The person contemplating a Chapter 7 Bankruptcy must first assess whether or not he or she is eligible to file. Requirements are relatively easy. Currently, the requirements are that you have not filed for Chapter 7 Bankruptcy in the previous eight years or a Chapter 13 Bankruptcy that paid less than a 70% dividend to unsecured creditors in the previous six years. In fact, a person filing for chapter 7 need not be a citizen or even a legal resident of the United States, the Code requires that the debtor simply must be a “resident.” If you meet these simple factors, then you would be eligible to file a chapter 7.

Next, it is important to assess the advisability of filing a case. This is a more complicated question as bankruptcy laws are complicated. Generally, if you spend more money each month than you make, if you earn less than the average household size in your state, and you do not own any non-exempt assets, a Chapter 7 bankruptcy would likely be successful. Obviously where you live is important as the median income numbers and your budget can all affect the success of your case.

Once it appears you are eligible and that a bankruptcy would successfully accomplish what you hope, the process can also be complicated. Before you can file a case, the law requires every debtor to complete a credit counseling session. Once this is complete, the legal process of filing a Chapter 7 Bankruptcy begins with the preparation and filing of the bankruptcy petition and schedules. The bankruptcy petition and schedules are a series of documents that contain information about your debts, your assets, income and general financial status for the previous few years. The bankruptcy petition is used to demonstrate that you qualify for Chapter 7 discharge, determine which of your debts will be eliminated, what property you will be allowed to keep and which debts you have chosen to keep.

Once your case is filed, certain documents must be mailed to the trustee assigned to your case and you will be assigned a date for a meeting of creditors as provided under 11 U.S.C. §341. The meeting occurs approximately four to six weeks after the filing of the Chapter 7 Bankruptcy. The debtor’s attendance at this meeting is absolutely required, except in very rare circumstances. The Trustee presides over the meeting. The Trustee reviews the filing for possible fraud issues, represents your creditors, and evaluates your qualifications for Chapter 7 Bankruptcy. The Chapter 7 Trustee will also investigate property and valuation. One of the main duties of the trustee is to liquidate any non-exempt property and distribute the proceeds fairly among creditors. At the First Meeting of the Creditors, the Chapter 7 Trustee will ask a series of questions and typically make his or her findings during this short meeting. If the Chapter 7 Trustee issues a “no asset” report or “abandons” your property, the Chapter 7 Bankruptcy will proceed and the debtor will not lose any property.

If all goes well at the First Meeting of Creditors, approximately 60 to 90 days thereafter you will receive your discharge, and your case will close. During this period all of your creditors will be given an opportunity to review your Chapter 7 Bankruptcy filing and have the right to object to it. You will also be given the opportunity to reaffirm, or promise to keep paying on, your secured debts such as a home or a car. At the time of your discharge, your pre-filing unsecured dischargeable debt will be eliminated forever!

What Debts are not Discharged in Alabama?

Certain unsecured debts are non-dischargeable in Chapter 7 and Chapter 13. Examples of these are alimony and child support obligations, taxes less than three (3) years old, student loans (with the sole exception listed below), and any debts procured by fraud, incurring debt without a reasonably certain ability to repay the debt, and so forth. Certain debts related to a divorce proceeding, such as attorneys fees, may be dischargeable in Chapter 13, but not in Chapter 7. Federal, state and local taxes may be subject to specific time rules. Non-dischargeable debt is determined by federal bankruptcy law. Failure to pay any type of non-dischargeable debt will allow creditors to continue their collection process. Other non-dischargeable debts include mortgage liens, certain types of purchases for luxury items within 90 days of filing, secure debt, penalties and fines by government agencies, punitive damages assessed for “willful and malicious acts”, drunk driving fines, debts not outlined on the schedule and forms filed with the Bankruptcy Court and certain cash advances.

If you are an individual and meet the requirements, Chapter 7 allows you to discharge most or all of your debts. It allows you to do this regardless of how many assets you have or how much your creditors ultimately receive. It basically allows you to walk away from your debts and start over. Corporations do not receive discharges of debts, but there still may be some benefit to allowing a trustee to liquidate the assets.

What are some of the Advantages to a Alabama Chapter 7 Filing

- You receive a complete fresh start. After the bankruptcy is discharged the only debts you owe will be for secured assets on which you choose to sign a “Reaffirmation Agreement.”

- You have immediate protection against creditor’s collection efforts and wage garnishment on the date of filing.

- Wages you earn and property you acquire (except for inheritances) after the bankruptcy filing date are yours, not the creditors or bankruptcy court.

- There is no minimum amount of debt required.

- Your case is often over and completely discharged in about 3-6 months.

What are some of the Disadvantages of Chapter 7?

- You lose your non-exempt property which is sold by the trustee. If you want to keep a secured asset, such as a car or home, and it is not completely covered by your Alabama bankruptcy exemptions then Chapter 7 is not an option.

- If facing foreclosure on your home, the automatic stay created by your Chapter 7 filing only serves as a temporary defense against foreclosure.

- Co-signors of a loan can be stuck with your debt unless they also file for bankruptcy protection.

- If you filed a prior case and received a discharge of your debts, you can only file a second Chapter 7 bankruptcy case eight years after you filed the first case.

- Payments made to or on behalf of any relatives within twelve (12) months prior to filing your bankruptcy case are recoverable by the Trustee in your case. If you repaid money during that period to your brother or made payments on a credit card that your mother let you use, they will have to pay back that money to your Trustee who will then distribute it equally to all your creditors. This is one of the biggest mistakes people make, often innocently because they don’t know they will be filing a bankruptcy, but that’s the law. It’s designed to prevent debtors from preferring one creditor over another. The same is true for non-relatives, although the lookback period for them (such as credit cards, etc.) is only ninety (90) days and most people don’t really care if their Trustee sues the credit card company to recover the money.

If you are a corporation, you must stop operating your business immediately upon filing the Chapter 7 petition. Only under extraordinary circumstances will the Trustee operate a business.

What about your credit after a Chapter 7 case?

The bankruptcy will appear on your credit report for up to ten (10) years after you file. Other accurate negative reports on your credit must be removed after seven (7) years (like late payments on credit cards, foreclosures, etc). However, according to our former clients, this is usually not as big a problem as most people think. Credit lending agencies know you won’t be able to file another bankruptcy for at least 6 years, and therefore, they don’t have that risk to bear. You will not get as high a credit limit as you once had, or be able to borrow a large sum of money, but getting some credit (such as a secured credit card) shouldn’t be that difficult and you can rebuild your credit over time. What you will likely face is higher interest rates, required higher down payments, more points, etc. Some people do have difficulty rebuilding their credit, but it is usually due to other factors besides bankruptcy, such as their employment record, other credit problems, etc. In any event, we can provide you with excellent materials for helping you rebuild your credit should you so desire. Having practiced in Alabama for over 20 years, we have seen a lot of different scenarios. See an attorney for more information. Call us today at 256-534-3435 or 1-800-752-1998.

Attorney Fees

What is average in your city or county might not be so average in another area. Attorney fees vary by city, county and/or district and can even vary widely from state to state. A recent study showed that the average fee for a Chapter 7 bankruptcy, nationally, is between $1,080 and $1,200. But when it was broken down by state, the average fee was as low as $700 in Idaho and as high as $1,530 in Arizona. Fees in the Southwest tend to be the highest, with fees in the Midwest generally among the lowest. Currently, fees ranging from $1200 to $2500 are considered ordinary, depending on your location. In North Alabama, current fees range from $1,200.00 to $1,800.00.

If you see a newspaper, billboard or television advertisements that promise unusually low attorneys fees in Alabama, be on alert. The advertisements are usually deceptive. Often the attorney increases the quoted fee once you start the bankruptcy process. For example, the attorney might say he or she must charge you more because you have more than a threshold number of creditors, your debt is over some predetermined limit, or you are filing jointly with your spouse. However, these factors rarely make a Chapter 7 bankruptcy more complicated so do not usually justify a higher fee.

Attorneys fees charged often depends on the complexity of the case or experience level of the attorney, factors such as the number of creditors and the amount of debt should not, by themselves, change the fee you are charged. Consumers often have thirty to forty creditors listed. An average small business bankruptcy could easily have double or triple that amount. The fact that you are filing jointly with your spouse, rather than individually, should not increase the fee. A case where a married person is filing individually and their spouse is not filing usually involves more legal analysis and is more complex than when both spouses are filing together. Remember, the fee you are quoted often does not tell you anything about the qualifications of the attorney. Many attorneys provide a free initial consultation or charge a small fee for the consultation which can be applied to the overall attorney fee if you do file. In addition to getting some free or low-cost legal advice, this is an opportunity to size up your prospective lawyer. Your initial consultation should be with the attorney, not a secretary or paralegal. Apart from meeting with the attorney, inquiring about qualifications, and feeling comfortable with the answers and advice you are getting, referrals from a friend or relative are probably the best way to find a good Decatur or Huntsville bankruptcy attorney. Remember, at the law firm of Ferguson & Ferguson, we are here to help. Call now. Call 256-534-3435 or 256-350-7200. We are here to help.

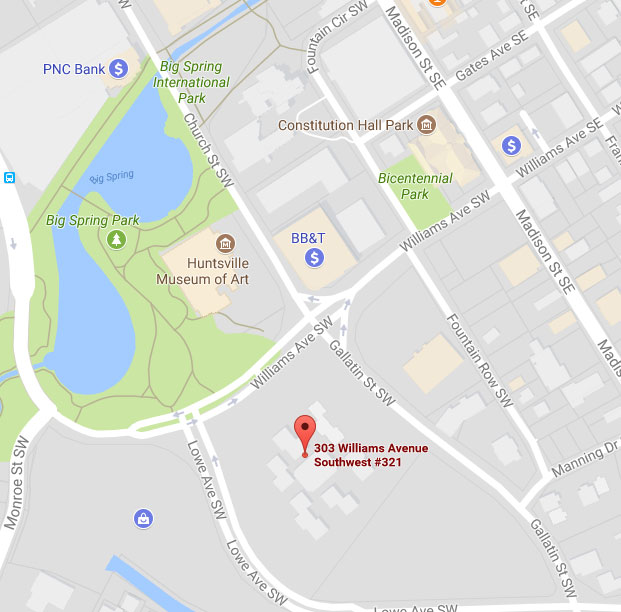

Huntsville Office Location:

303 Williams Avenue SW

Suite 321

Huntsville, AL 35801

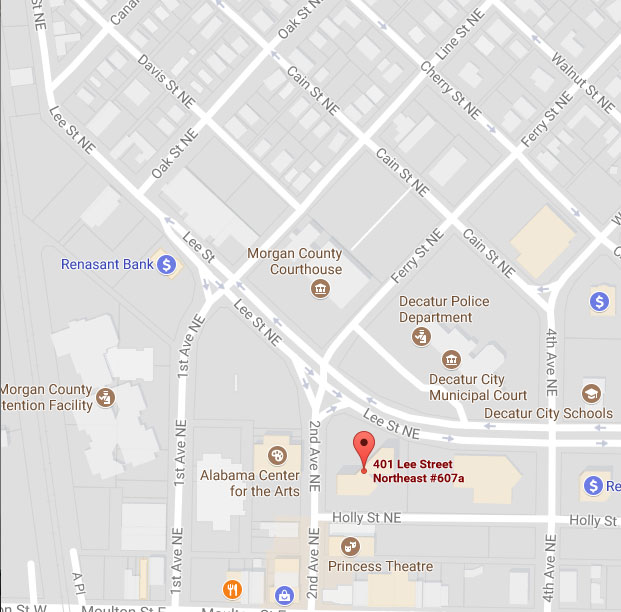

Decatur Office Location:

211 Oak Street

Decatur, AL 35601