DEBT CONSOLIDATION OR BANKRUPTCY IN ALABAMA

Do you really understand what debt consolidation and debt settlement mean? There are several alternatives to filing for bankruptcy for individuals who are facing financial difficulties from credit card debt, loans, and medical bills. The following are a few of the alternatives available to individuals in Huntsville, Alabama.

Debt Settlement

Often times your creditors may be willing to settle your debt for a lump sum payment of a percentage of your debt. The percentage that they are willing to accept under what terms is dependent on which creditor you are negotiating with and your negotiating skills. You can negotiate these terms on your own or seek a company who specializes in debt settlement. Ensure that any company that you select to negotiate your debt is reputable and is charging you reasonable fees. Debt settlement companies generally work by accumulating your funds in an account until there is enough money in the account to pay one creditor. This process is repeated for each creditor that money is owed to. There are some drawbacks to debt settlement that you should also be aware of when selecting this option:

First debt settlement can be a lengthy process. There are creditors who may be difficult to negotiate with and may take their time by agreeing to settle. In addition, this process may take some time since you will have to accumulate money for each creditor to pay the agreed lump sum to each creditor. During this process, you will have to deal with harassing creditor calls.

Second debt settlement does not protect you from creditor lawsuits; While you or your debt settlement company are negotiating with your creditors, you are at risk for possible lawsuits from your creditors.

Third, you will generally pay taxes on most of the debt forgiven, as taxable income.

Debt Consolidation

You have probably seen or heard advertisements for debt consolidation services that promise to work with your creditors to consolidate your debt and significantly lower your monthly payments. We urge you to use caution before contacting one of these services. Debt consolidation involves combining all of your unsecured debt and making one monthly payment, with generally a lower interest rate. Companies that assist with debt consolidation attempt to lower your finance charges and interest rates by working with your creditors. The question is how are they going to get your creditors to go along with the plan? Generally, debt consolidation companies can obtain lower interest rates on your unsecured debts, but there may be companies that that are unwilling to lower your interest rates. If, after months of waiting, the company is not able to help you, you will be left with all of the debt plus months of interest and/or late fees. Plus, you probably paid good money to the debt consolidation service. More often than not, the fees are more excessive for less relief than a discharge in a bankruptcy. There are other drawbacks to selecting debt consolidation to handle your debts:

First it may be difficult to complete the program where you are struggling with paying for basic necessities. Although debt consolidation may lower your interest rates, it is not a viable alternative where you are struggling to pay for food, clothing, medical and other basic necessities.

Second you are generally required to agree that you will close your account and not open new accounts unit you complete the program. This can be extremely difficult where paying 100% of your debt will take many years.

Free Consultation

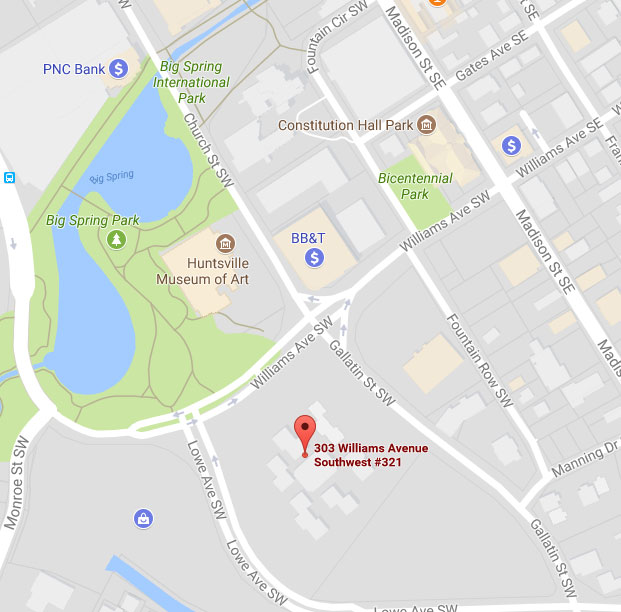

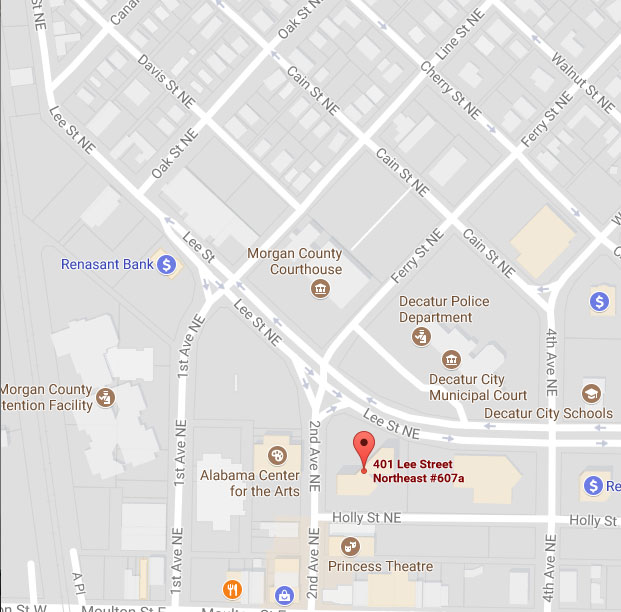

To learn more about debt consolidation, come in today for a free consultation with one of our experienced bankruptcy attorneys. Call 256-534-3435. We are here to help.